SAW Reimbursement

Starting January 2025 - Double Your Stay-at-Work Reimbursement.

Did you know a portion of your workers’ compensation premium is used to pay for this program? Stay at Work (SAW) is a financial program administered by Labor and Industries (L&I), incentivizing employers to bring their injured workers back to modified-duty or transitional work—a process known as Return to Work (RTW)—as soon as possible.

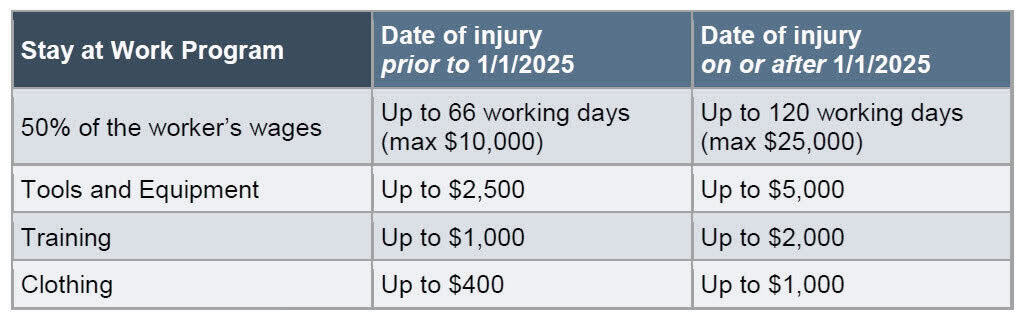

For injuries on or after January 1, 2025, L&I will reimburse 50% of base wages up to 120 workdays or $25,000* per claim.

*Claims prior to January 1, 2025, are reimbursed 50% of base wages up to 66 workdays or $10,000 per claim.

ERNwest can complete and submit your paperwork to L&I for a small fee.

Required Documents

Know what is needed after an injury occurs to get the most out of SAW and RTW.

1

Verification that the injured worker is not able to perform his/her usual job.

2

Written description of modified-duty job approved by medical provider.

3

Verification that days worked and payments made correspond to the modified-duty job.

Types of documentation

- Activity Prescription Form (APF) (typical/preferred)

- Chart notes

- Prescription(s)

Types of documentation

- Return to Work Form (RTWF)

- Modified Duty Job Description (MDJD)

Types of documentation

- Pay stubs (proof of wages paid)

- Timecards (proof of days/hours worked)

BEST PRACTICE

REASONABLY CONTINUOUS

JOB OFFER LETTER

This letter details the parameters of the modified duty that is outlined in the RTWF or MDJD and helps protect the employer and employee. Your claims manager can help.

Common Pitfalls

Why a SAW reimbursement is denied, or a company only receives partial reimbursement.

Document does not clearly state the start and end dates or dates are not accurate.

Example: If an APF approves restrictions from Aug 1 – Aug 30 but modified duty is performed from Aug 1 – Sep 30, L&I will only reimburse days between Aug 1 – Aug 30.

Tip: Worker must attend their follow up visits and obtain documentation (RTWF or APF) for continued modified duty.

RTWF or MDJD is not signed or filled out correctly.

Example: If the physician does not sign the RTWF in a timely manner, does not include dates or the description of the modified-duty job is not in line with the physical restrictions, it can cause the claim to be ineligible or be delayed.

Tip: Provider date of signature is the first day of eligibility.

Worker performs job outside the physical restrictions or approved hours.

Example: The injured employee works outside of the approved job description or approved hours (works 6 hours when only 4 have been approved) that day is not eligible for reimbursement.

Tip: Practice good communication and supervision to ensure restrictions are followed by employee.

Assuming an APF is the only form needed to be eligible for SAW reimbursement.

Example: An APF lists restrictions and dates but does not spell out what an employee will actually do on modified duty. An attending physician must also approve what tasks the injured worker will perform on modified duty.

Tip: Have an internal process when there is a workplace injury that includes using a RTWF.

Copyright © 2025 ERNwest. All rights reserved. The information contained in these web pages is intended for client use only. Our content may not be sold, reproduced, or distributed without our written permission.